On Wednesday, the Senate Special Committee on Aging held a hearing titled “That’s Not the Government Calling: Protecting Seniors from the Social Security Impersonation Scam.” The purpose of the hearing was to address the current #1 scam that seniors are falling victim to today – social security fraud. In 2019 alone, $38 million was lost to this type of fraud, not including those who didn’t report their losses.

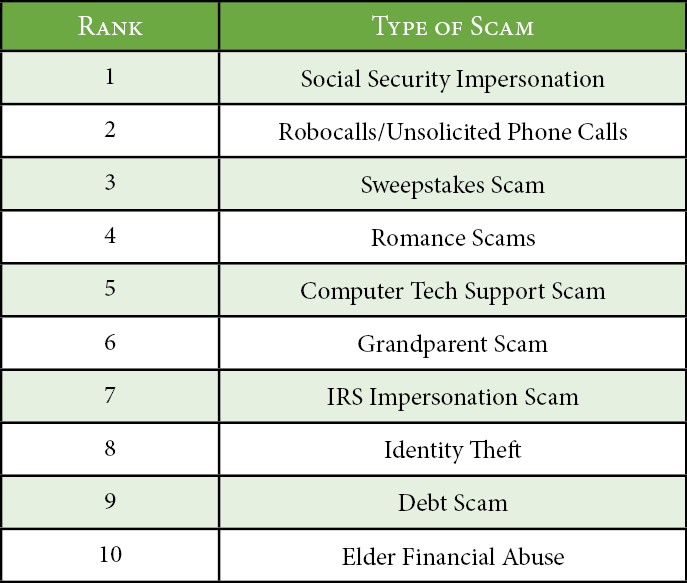

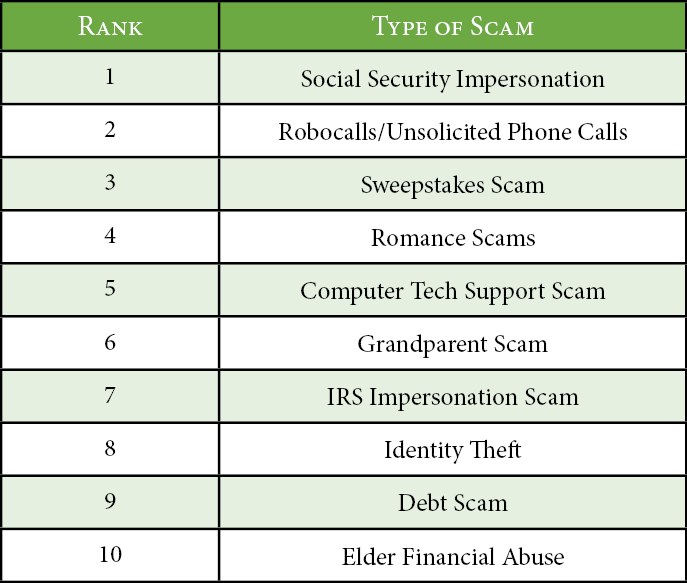

The Senate Special Committee on Aging also released it’s 2020 Fraud Book which details the top ten most-reported scams that are damaging the lives of older adults today. Here’s a look at the list, a little bit about these types of scams, and how you can protect yourself and your loved ones from becoming victims:

Top 10 scams from United States Senate Special Committee on Aging, “Fraud Book 2020”

2019 marked a significant shift in the type of scam being reported to the senate. Formerly, IRS impersonation scams were the most frequently reported issue, but this past year Social Security fraud has taken over.

According to the Fraud book, the deception usually comes in the form of a phone call where the caller ID may show “Social Security Administration.” A person on the other end poses as an SSA employee, trying to resolve an issue such as a compromised social security number (SSN), or stating that one’s SSN has been linked to a crime. The “solution” to these issues is usually to either provide personal information or submit some form of payment.

A victim’s story:

During this week’s special committee hearing, a victim of social security fraud shared her own story about how she was conned out of $150,000 – almost giving out more money until she decided to verify the con artist’s story. Machel Andersen explained that she received a phone call stating that her “Social Security number had been compromised and a vehicle registered in [her] name was found at a crime scene.” In order to avoid what she thought could mean potential arrest, Mrs. Andersen cooperated with the con artist.

Social Security Administration Commissioner, Andrew Saul went on to share actions that are being taken to prevent these scams from occurring. These actions include working with major phone carriers to block impersonators, wide-range television campaigns, consumer education, and more.

Some other major scam-types affecting older adults include:

- Sweepstakes scams: One is told that they must pay “taxes” and “fees” up front before claiming their sweepstakes winnings

- Romance scams: after gaining the trust of vulnerable online dating members (over weeks, months, or even years), the scammer requests money to help with an unexpected emergency or bill

- Computer tech support scams: a message pops-up on the computer screen claiming that immediate tech support is needed and provides a toll-free number to call

The takeaway:

Older adults are not the only people susceptible to these types of scams. In fact, the Federal Trade Commission reported in 2018 that people 60 and older were 20% less likely then younger adults to report actually losing money to fraud. However, when they do, their losses are much higher. This is to say that no one is immune to becoming a victim. “Do not trust caller ID, do not give your Social Security Number or other personal information. Do not provide money. Our employees will never threaten or demand money from you,” shared commissioner Saul.

Make sure to always verify who you are dealing with via phone or online – and if you are ever suspicious, be sure to hang up and call Aging Committee’s Fraud Hotline (1 -855-303-9470) or visit oig.ssa.gov.

References: United States senate Special Committee on Aging, “Fighting Fraud: Senate Aging Committee Identifies Top 10 Scams Targeting Our Nation’s Seniors,” aging.senate.gov, accessed January 31, 2019